Key market drivers & production technologies for Sustainable Aviation Fuel

Main feedstock types & conversion processes for SAF production. Source: IDTechEx

Author: Chingis Idrissov, Senior Technology Analyst at IDTechEx

Aviation contributes 2.5% of global CO2 emissions and 12% of transport emissions, generating over 1 billion tonnes in 2019. While relatively small compared to road transport, aviation is one of the fastest-growing transport sectors, with ICAO forecasting a tripling of international aviation emissions by 2050 from 2015 levels without intervention. In addition, electric and hydrogen propulsion are challenging for long-range flights. Hence, SAF has emerged as a crucial decarbonization tool offering up to 80% emissions reduction while being drop-in compatible with existing aircraft engines and infrastructure.

This article discusses the key SAF production technologies and market drivers using research from IDTechEx’s report, "Sustainable Biofuels & E-Fuels Market 2025-2035: Technologies, Players, Forecasts".

Policy drivers for SAF, the HEFA process, and the current state of the market

SAF efforts are primarily driven by ambitious regulatory mandates, with the EU leading through its ReFuelEU Aviation Initiative requiring a 2% SAF blend by 2025, rising to 6% by 2030, 34% by 2040, and ultimately 70% by 2050. The US has set its own target of 3 billion gallons by 2030 and 35 billion gallons by 2050, while other nations globally have proposed mandates ranging from 2-10% SAF use by 2030. These mandates, coupled with government incentives, are driving the rapid emergence of SAF production facilities. Global SAF production capacity will scale to over 2 million tonnes by the end of 2024. Yet, demand is expected to outstrip production capacity due to policy mandates and voluntary airline commitments, coupled with lagging project development.

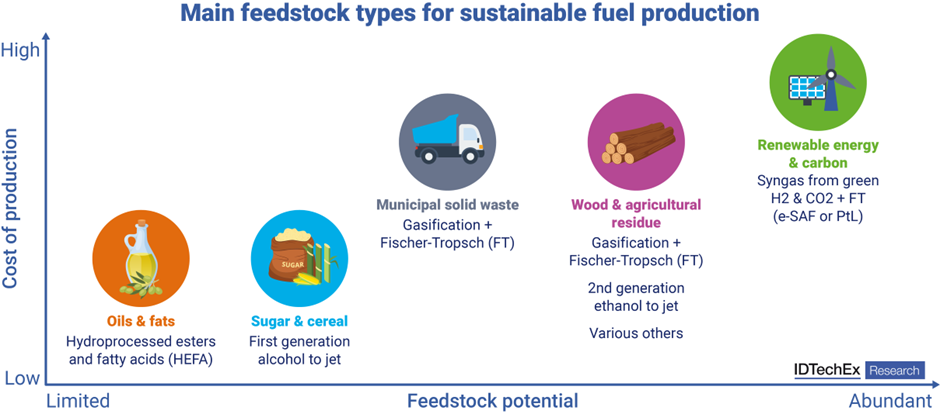

HEFA, or hydroprocessed esters and fatty acids, is the dominant SAF production process involving the hydroprocessing of lipid feedstocks like used cooking oil, animal fats, and vegetable oils. It accounts for all SAF production today and over 80% of announced SAF capacity by 2030. While it is mature and proven, its scalability is constrained by the limited availability of waste lipid feedstocks and competition with renewable diesel production. This necessitates next-gen technologies that can use more abundant feedstocks like agricultural residues, forestry waste, municipal waste, and captured CO2.

Gasification-FT pathway

The gasification-Fischer-Tropsch synthesis (FT) pathway is versatile as it converts various solid biomass and waste feedstocks into syngas that is catalytically upgraded to liquid hydrocarbons. It also benefits from extensive commercial experience in coal-to-liquids plants and can use various feedstocks while producing high-quality SAF. Recent technological advances are improving the pathway’s economic viability, including novel gasifier designs that reduce tar formation, microchannel FT reactors that offer superior heat management and conversion rates, and improved FT catalysts that enhance selectivity towards kerosene-range hydrocarbons. While high capital costs, large-scale requirements, and technical complexity in handling mixed feedstocks remain challenging, several commercial-scale projects are advancing with modular designs and enhanced process integration strategies.

Alcohol-to-jet (ATJ) pathway

ATJ pathways are promising routes to SAF as they can use existing bioethanol production infrastructure and emerging alcohol synthesis technologies. The most developed route is ethanol-to-jet (ETJ), which capitalizes on the established bioethanol industry or the emerging 2nd gen cellulosic ethanol. ETJ involves dehydration to ethylene, oligomerization to higher olefins, and hydroprocessing to produce SAF. Methanol-to-jet (MTJ) is gaining attention due to the scale-up of biomethanol production. Higher alcohols like isobutanol are also being considered by some companies.

ATJ offers the benefit of having mature technologies that have been used on commercial scales but never combined for SAF production. While ATJ pathways face challenges, including process complexity and energy intensity, they benefit from flexible feedstock options and the ability to leverage existing alcohol production facilities. Several commercial projects are advancing, particularly for ETJ, with enhanced economic viability expected after many repeated plants have been constructed.

Pyrolysis and hydrothermal liquefaction

Pyrolysis and hydrothermal liquefaction (HTL) offer a way of avoiding gas intermediates by directly producing a liquid biocrude oil intermediate for SAF production. Fast pyrolysis breaks down feedstocks into hydrocarbons using high temperature and pressure without oxygen. While it is potentially cost-effective, it also produces bio-oil with challenging characteristics, including high oxygen content, acidity, and thermal instability, making downstream upgrading to aviation fuel specifications challenging and energy-intensive. Consequently, pyrolysis players have found greater commercial traction in plastic waste recycling and biochar production rather than fuels.

In contrast, HTL operates in a high-temperature and pressure water environment, producing a high-quality biocrude with lower oxygen content, higher energy density, and superior stability. HTL’s key advantage lies in its ability to process wet feedstocks (including sewage sludge, algae, and organic waste) without energy-intensive drying while also offering high carbon efficiency and reduced hydrogen requirements in upgrading. Recent technological advances in HTL include improved heat recovery systems and novel plug flow reactor designs. While this technology still needs to scale up to industrial scales, several demonstration projects are showcasing HTL’s potential for commercial SAF production, especially when integrated with assets like wastewater treatment plants.

e-SAF production

e-SAF pathways, which produce kerosene from green hydrogen and captured CO2, represent a potentially scalable route to carbon-neutral aviation fuel. Two main pathways are emerging in commercial projects, both aiming to use technologies available on the market today. The methanol-to-jet (MTJ) pathway uses green hydrogen and CO2 to first produce e-methanol, which is then converted to jet fuel via MTJ technology. The RWGS-FT pathway produces syngas from CO2 and hydrogen via reverse water gas shift (RWGS), followed by Fischer-Tropsch synthesis.

While they offer theoretical advantages of unlimited feedstock availability and excellent product quality, the process economics are largely prohibitive due to the high costs of green hydrogen production and the need for sustained access to biogenic or direct air captured CO2 for true carbon neutrality. Many e-fuel projects plan to use CO2 from industrial flue gas, the use of which will be more restricted in the EU by the mid-2030s. However, the biggest challenge is cost, as current e-SAF production costs can be 4-10 times that of conventional jet fuel versus 2-5 times for bio-SAF, necessitating substantial government support.

Nevertheless, the EU’s ReFuelEU Aviation regulation includes specific e-SAF sub-mandates (starting at 1.2% in 2030 and rising to 35% by 2050), recognizing e-SAF’s importance as a long-term solution. The mandate, along with incentives for green hydrogen, is driving investment into projects. Improvements in electrolyzer efficiency, green hydrogen costs, CO2 capture costs, and process integration will gradually make e-SAF more competitive, though significant scale-up of renewable energy infrastructure and continued policy support will be crucial for commercial viability.

Summary, outlook, and more insights

No SAF production pathway is a silver bullet solution, as each technology has unique advantages and challenges. The HEFA pathway offers immediate commercial viability but faces long-term feedstock constraints, while gasification-FT and alcohol-to-jet routes provide feedstock flexibility but require more commercial experience and large-scale facilities. HTL shows promise for wet waste valorization, and e-SAF pathways, despite current high costs, offer long-term scalability potential.

SAF technology and project developers are improving commercial viability through learning experiences in first-of-a-kind plants, which will eventually bring down costs. However, costs are likely to stay at several times that of jet fuel. While government mandates create a market and stimulate investment, more support from regulators is needed to advance projects to final investment decisions (FIDs). As aviation fuel demand grows and decarbonization mandates become more stringent, a diverse portfolio of SAF production technologies will be essential to meet the industry’s ambitions, with continued technological innovation and policy support playing vital roles.

The sustainable fuel market is poised for substantial growth in the coming years. IDTechEx forecasts that global production capacity for renewable diesel and SAF will exceed 57 million tonnes annually by 2035. For more detailed insights into production technologies, key industry players, project case studies, and market forecasts for renewable diesel, SAF, and renewable methanol, refer to IDTechEx’s report: “Sustainable Biofuels & E-Fuels Market 2025-2035: Technologies, Players, Forecasts”.

To find out more about this IDTechEx report, including downloadable sample pages, please visit www.IDTechEx.com/Biofuels.